Guide Your Rugby Earnings to Victory.

We’re not a bank.

We’re not a call centre.

Elite FX is a specialist company that helps professional athletes, coaches, and high earners move money between countries.

Our team has over 40 years of experience in foreign currency exchange. We understand the problems you face—like bad exchange rates and high fees—and we know how to fix them.

Sending Your Money Home

As a top rugby player living abroad, you send money back home regularly. But with ever-changing currency rates, you could lose out on thousands if you’re not careful.

Elite FX Can Help

We protect your earnings by shielding them from sudden drops in currency value, giving you peace of mind.

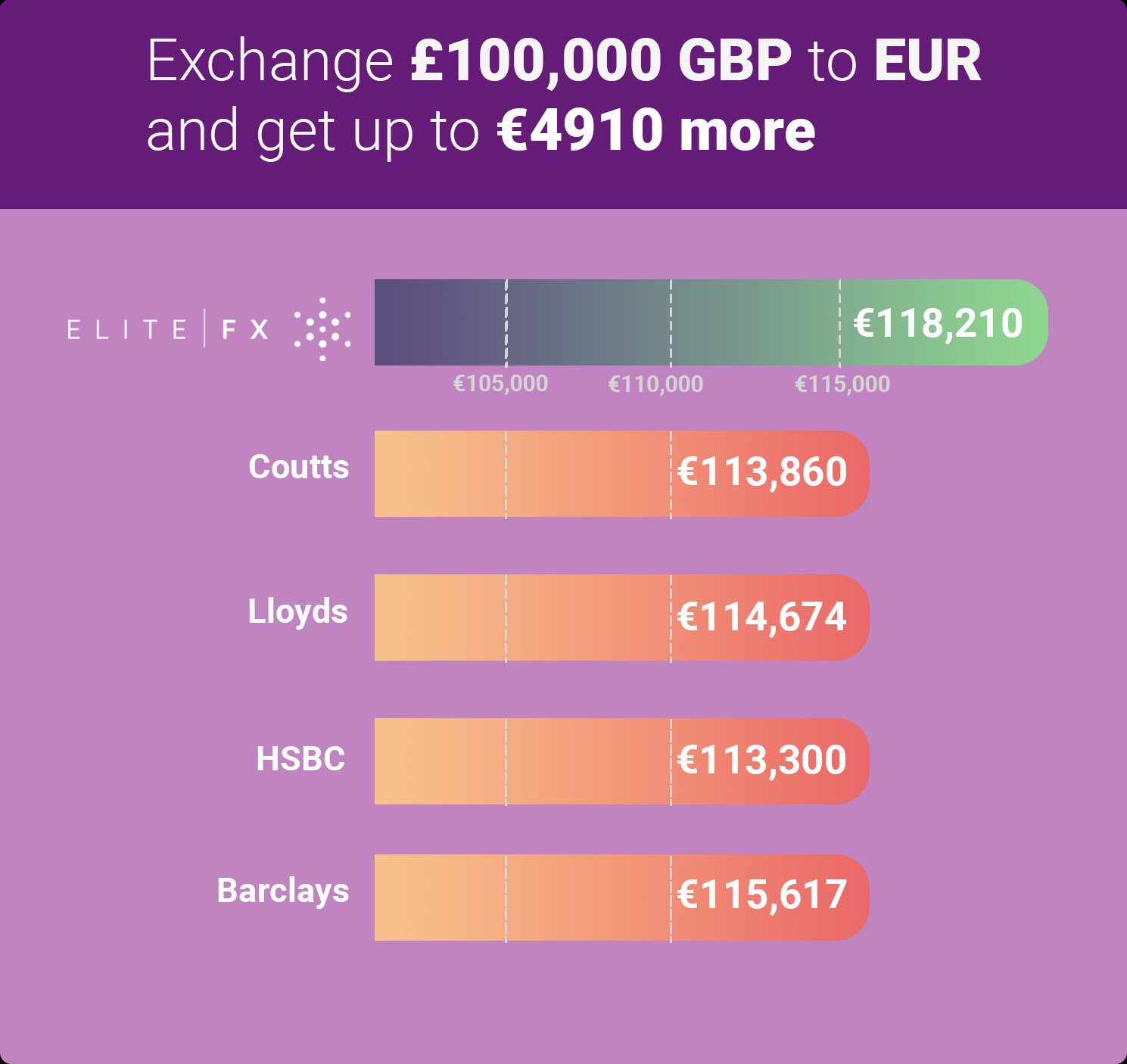

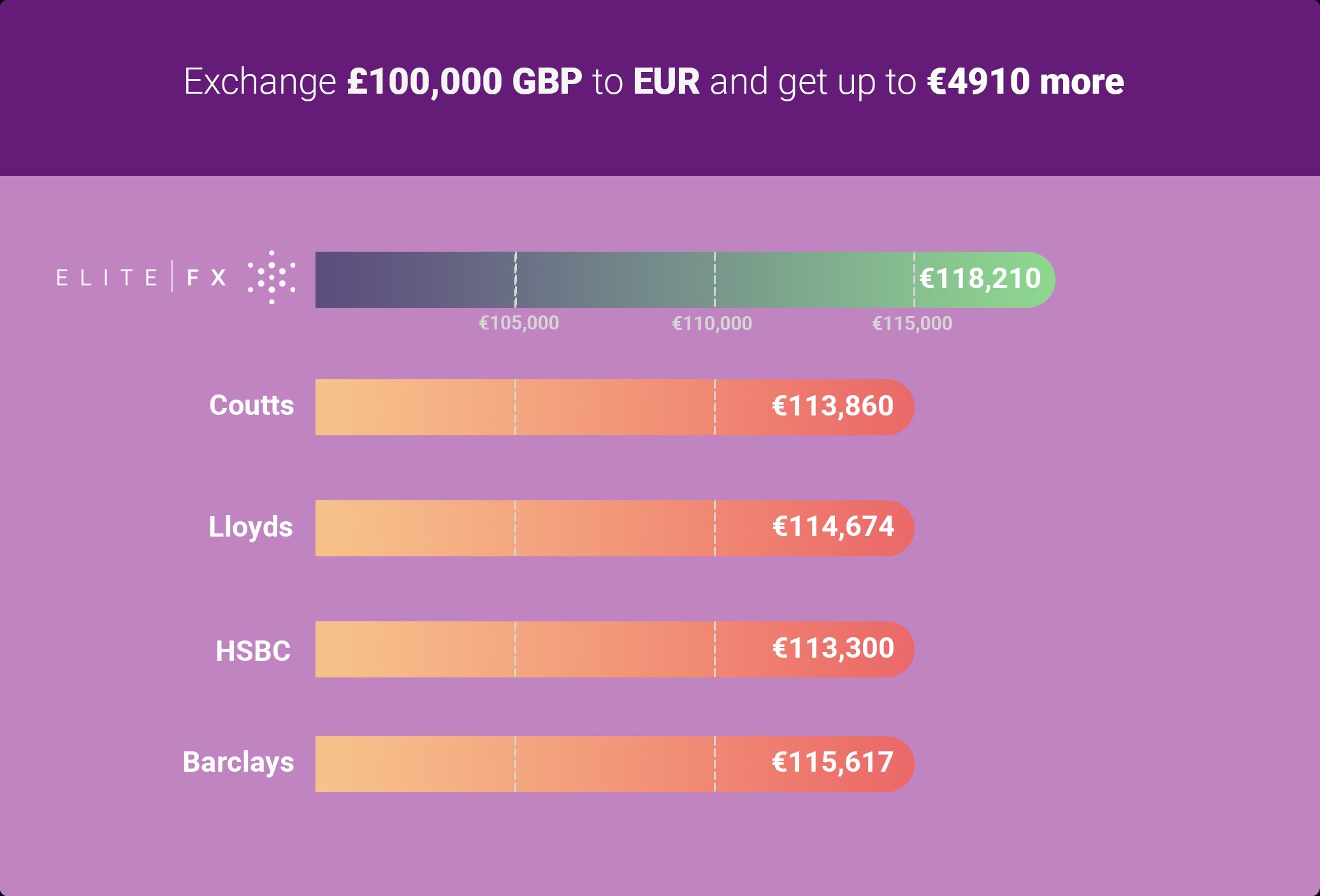

Stop Losing Money to the Banks

We work with famous sports stars from around the world. Our clients include Rugby World Cup winners, UEFA Champions League football players, Olympic gold medalists, world-renowned golfers, and Ashes-winning cricketers.

Elite-FX has helped over 100 top athletes. These athletes have represented their clubs and countries, including England, France, Australia, South Africa, Portugal, Spain, and Argentina, winning major trophies in international and local competitions.

Our Ambassadors

Protect Your Earnings from Currency Volatility

Currency fluctuations can directly impact the value of your hard-earned money. The examples below shows how exchange rates can affect the amount you receive when transferring funds.

- Example: JP¥ to AU$

- Example: JP¥ to NZ$

- Example: JP¥ to ZAR

- Example: AU$ to GBP

- Example: US$ to GBP

- Example: EUR to GBP

Scenario:

You transferred JP¥ 35,000,000 to AU$. Here’s what you would have received at the highest and lowest exchange rates this year:

| Date | Exchange Rate | Amount Received (AU$) |

|---|---|---|

| 5 August 2024 | 90.05 (High*) | AU$ 388,672.96 |

| 11 July 2024 | 109.37 (Low*) | AU$ 320,014.63 |

| Difference | -AU$ 68658.33 |

AU$ Difference: - AU$ 68658.33

By transferring your funds at the best rate, you would have gained 21.45% or AU$ 68658.33 more compared to the lowest rate.

Safeguard Your Income:

Our protection plan locks in a consistent exchange rate, ensuring your earnings aren’t eroded by market fluctuations.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Scenario:

You transferred JP¥ 35,000,000 into NZ$. Here’s what you would have received at the highest and lowest exchange rates this year:

| Date | Exchange Rate | Amount Received (NZ$) |

|---|---|---|

| 5 August 2024 | 83.03 (High*) | NZ$ 421,534.39 |

| 10 July 2024 | 99.01 (Low*) | NZ$ 353,499.65 |

| Difference | -NZ$ 68,034.74 |

NZ$ Difference: - NZ$ 68,034.74

By transferring your funds at the best rate, you would have gained 19.25% or NZ$ 68,034.74 more compared to the lowest rate.

Safeguard Your Income:

Our protection plan locks in a consistent exchange rate, ensuring your earnings aren’t eroded by market fluctuations.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Scenario:

You transferred JP¥ 35,000,000 into ZAR. Here’s what you would have received at the highest and lowest exchange rates this year:

| Date | Exchange Rate | Amount Received (ZAR) |

|---|---|---|

| 4 January 2024 | 7.5500 (High*) | ZAR 4,635,761.59 |

| 1 July 2024 | 8.9700 (Low*) | ZAR 3,901,895.21 |

| Difference | ZAR -733,866.38 |

ZAR Difference: ZAR -733,866.38

By transferring your funds at the best rate, you would have gained 18.81% or ZAR 733,866.38 more compared to the lowest rate.

Safeguard Your Income:

Our protection plan locks in a consistent exchange rate, ensuring your earnings aren’t eroded by market fluctuations.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Scenario:

Example: You sent AU$ 250,000 to the UK. Here’s what you could have received at the best and worst exchange rates this year:

| Date | Exchange Rate | Amount Received (£) |

|---|---|---|

| 5 August 2024 | 1.8559 (High*) | £ 134,705.53 |

| 15 May 2024 | 2.0037 (Low*) | £ 124,769.18 |

| Difference | -£ 9,936.35 |

GBP Difference: - £ 9,936.35

By sending your money at the best rate, you would have gained 7.96% or £ 9,936.35 more compared to the worst rate.

Keep Your Income Safe:

Our plan locks in a steady exchange rate, so your earnings stay secure, no matter how the market moves.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Scenario:

You transferred US$ 250,000 USD to the UK. Here’s what you would have received at the highest and lowest exchange rates this year:

| Date | Exchange Rate | Amount Received (£) |

|---|---|---|

| 21 August 2024 | 1.2299 (High*) | £ 203,268.56 |

| 22 April 2024 | 1.3052 (Low*) | £ 191,541.53 |

| Difference | -£ 11,727.03 |

GBP Difference: - £ 11,727.03

By transferring your funds at the best rate, you would have gained 6.12% or £ 11,727.03 more compared to the lowest rate.

Safeguard Your Income:

Our protection plan locks in a consistent exchange rate, ensuring your earnings aren’t eroded by market fluctuations.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Scenario:

You transferred EUR 250,000 into UK£. Here’s what you would have received at the highest and lowest exchange rates this year:

| Date | Exchange Rate | Amount Received (£) |

|---|---|---|

| 23 April 2024 | 1.1567 (High*) | UK£ 216,132.10 |

| 17 July 2024 | 1.1928 (Low*) | UK£ 209,590.88 |

| Difference | -£ 6,541.22 |

GBP Difference: - £ 6,541.22

By transferring your funds at the best rate, you would have gained £ 6,541.22 more compared to the lowest rate.

Safeguard Your Income:

Our protection plan locks in a consistent exchange rate, ensuring your earnings aren’t eroded by market fluctuations.

*Note: The actual exchange rate highs and lows used in this example were taken between January 1st and August 21st, 2024. We show this to highlight that without taking action, you are fully exposed to market volatility.

Stay Ahead of Currency Fluctuations.

Currency rates have been unpredictable over the past decade. Without protection, you risk losing a significant amount when rates are unfavourable.

While we can’t control the market, Elite FX offers a tailored plan that reduces your exposure to big losses.

Elite FX can’t control the market, but we offer a plan that shields you from big losses.

The Elite FX Protection Plan

Our Earnings Protection Plan is custom-built for top athletes like you, ensuring that your earnings are shielded from currency fluctuations.

Fixed Exchange Rates: Lock in a steady rate for part of your salary.

Risk Reduction: Protect your income from unfavourable exchange rates.

Financial Security: Feel confident knowing your money is safe and growing.

Custom Plans: Adapt the plan to suit your specific needs and goals.

Your Key Benefits:

Expert Support: Get advice from our currency specialists who know the game.

No Hidden Fees: We don’t charge fees—just a small margin on the exchange rate.

Get Started Today

💬 Find out how Elite FX can help you protect your earnings and stay ahead in the game. Contact us now for your free consultation.

Pro Rugby Players can open an Elite-FX account by clicking here:

Prefer a zoom call

Schedule a Free Zoom Call by filling out the form opposite.

Speak with our experts about protecting your earnings. No obligation—just helpful advice!

info@elite-fx.com

+44 (0)208 1297217

Chat with us on WhatsApp

Chat with us on WhatsApp

Send us an email

Send us an email